The phrase “Sell America” has evolved from a trading meme to a financial reality. From US Treasuries to the US Dollar all the way to the biggest US stocks.

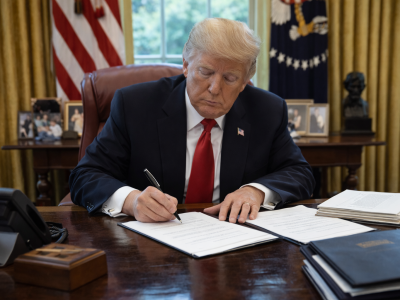

This week, after a chaotic bond selloff and a three-day market rout, President Donald Trump backed off his aggressive tariff plan. At least partially.

But the damage is done. Even after the White House offered a 90-day pause on tariffs for most countries, US futures stayed flat while global stocks kept surging.

The bond market is still rattled. And for the first time in years, investors are openly questioning whether US assets are still the safe haven they once were.

What just happened to US markets?

From Friday to Wednesday, investors saw a kind of synchronized selloff that doesn’t usually happen in developed economies.

The S&P 500, Treasuries, and the dollar all dropped sharply. The 10-year U.S. Treasury yield spiked 60 basis points in three sessions. That was its sharpest move since 2001. Nasdaq fell into correction territory before rebounding 12% in a single day after the tariff pause was announced.

Normally, when equities fall, bonds rise. That didn’t happen this time. Instead, hedge funds dumped Treasuries in a wave of forced selling linked to a failed basis trade strategy.

The fallout was amplified by thin market liquidity and leveraged positions. At one point, the 10-year yield hit 4.515%, up from 3.9% just days earlier.

The U.S. dollar also weakened against safe havens like the yen and Swiss franc, despite rising yields. The Dollar Index (DXY) remains down for the month. The dollar’s inability to attract capital in a moment of global stress was a big red flag.

Why did Trump reverse course?

Trump’s tariff reversal was not about diplomacy or economics. It was about markets.

According to Bloomberg and White House insiders, Trump spent the early part of the week watching bond yields, equity charts, and Fox Business commentary.

When the 10-year yield shot past 4.5% and high-profile allies like Jamie Dimon and Bill Ackman warned of recession, Trump blinked.

Within hours, his team drafted a post for Truth Social, rolling back tariffs for most countries, except China, and sent it live without legal review.

The move triggered the biggest single-day jump in the Nasdaq since 2001. But the bond market barely reacted. And that tells us something more serious. Perhaps the markets don’t believe this is over.

Is this the end of the US safe haven myth?

The phrase “Sell America” became a viral headline this week for a reason. Investors didn’t just sell US stocks.

They sold bonds. They sold dollars.

They sold everything. And it wasn’t just day traders or speculative funds. It was pension funds, foreign central banks, and institutional investors rebalancing away from US exposure.

Part of this is technical. Basis trades blew up. Hedge funds got margin calls. Dealers lacked balance sheet capacity to absorb the flows.

But part of it is structural. The US is now running high deficits, high inflation, and unpredictable trade policy, all at the same time. That’s not a safe haven. That’s a risk asset with reserve currency privileges.

Foreign investors seem to agree. China reportedly holds around $800 billion in US Treasuries.

While there’s no hard evidence of active dumping, the 3-year Treasury auction this week had one of the weakest foreign bids in years.

According to Morningstar, domestic buyers only absorbed 6.2% of the supply, compared to an average of 19%.

Meanwhile, German bunds held steady. The euro gained against the dollar. And gold climbed above $3,100 an ounce, as investors seek safety elsewhere.

Should we panic?

This is not a crisis, yet. But it is a big paradigm shift. The Fed has limited room to maneuver. Minutes from its March meeting showed concern that tariffs would raise inflation.

Markets are now pricing in fewer rate cuts for the year, down from over 100 basis points to around 80.

If yields stay elevated and inflation climbs due to tariffs, the Fed may be forced to sit on its hands as the economy slows.

Trump, meanwhile, has already stated that the tariff pause is just that: a pause. The 10% blanket duty on all imports remains.

The China tariff has been raised again, now at 125%. A fresh set of trade tensions could reignite another selloff. The market has already shown what happens when it loses faith.

There’s also the risk of global retaliation. China has imposed 84% duties on US goods and sanctions on 18 American companies.

Europe is under pressure to respond. The long game, especially with China, is now a test of economic endurance.

Trump is playing chicken. But China seems prepared to absorb the pain. Game theory suggests the side most willing to suffer usually wins.

Finally, there’s another big risk here beyond tariffs. The risk that global investors are losing trust in US economic governance. The chaotic policy flip-flops. The messaging via social media.

The detachment between what’s said in Washington and what’s actually happening in markets.

This past week showed that the market now sets the limits of US policy. When the bond market gets “yippy,” Washington listens. But that’s not a good thing. It means confidence is no longer automatic. The benefit of the doubt is gone.

For the first time in a generation, investors are pricing US assets not as the default destination, but as one choice among many. That’s the core of the “Sell America” trade. And even if it pauses, the idea is now in play.

The post ‘Sell America’: the market revolt that forced Trump’s hand appeared first on Invezz