Dow futures surged over 120 points on Monday, indicating a positive start to the week ahead of key earnings and inflation data releases.

The futures tied to other Wall Street indices like the S&P 500 and Nasdaq 100 also gained 0.3% and 0.4%, respectively.

The uptick followed a week of volatility marked by trade tensions and regional bank weakness, though optimism persisted amid President Donald Trump’s comments about progress toward a potential trade deal with China and expectations of a possible Fed rate cut later in October.

5 things to know before Wall Street opens

1. As of Monday, the federal government remains shut down for the 20th consecutive day, making it the third-longest shutdown in US history.

The standoff continues between President Donald Trump and congressional Democrats over government spending levels and the renewal of healthcare subsidies tied to the Affordable Care Act.

More than 750,000 federal workers are furloughed, while essential employees in defense, law enforcement, and air traffic control continue to work without pay.

The Senate is scheduled to vote again Monday evening in its 11th attempt to end the shutdown, but a deal remains uncertain.

2. US Treasury yields ticked a bit higher as investors continued to assess the economic outlook during the ongoing government shutdown.

The 10-year yield inched up to about 4.01%, the 2-year stayed around 3.47%, and the 30-year rose to roughly 4.61%.

With the shutdown now stretching into a fourth week, sentiment in the market remains cautious.

Several key economic reports, including jobless claims, are on hold, and the September CPI reading has been pushed to Friday, adding to the uncertainty.

3. Third-quarter earnings reports are intensifying this week, with S&P 500 earnings forecasted to grow by 8.4% year-over-year, according to FactSet.

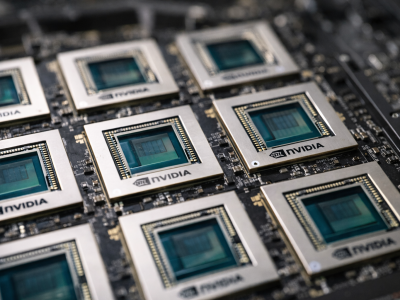

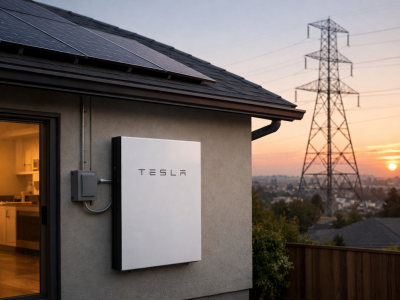

Key companies reporting include W.R. Berkley Corporation and Steel Dynamics on Monday. Netflix, GE Aerospace, Coca-Cola, Philip Morris International, RTX, Texas Instruments, Danaher, and Capital One on Tuesday.

Tesla, SAP, International Business Machines, Thermo Fisher Scientific, AT&T, Lam Research, GE Vernova, and Amphenol on Wednesday.

Thursday sees T-Mobile, Intel, Union Pacific, Honeywell, Blackstone, Newmont, and Norfolk Southern, while Friday features Procter & Gamble, Sanofi, HCA Healthcare, and General Dynamics.

4. Wall Street is showing a bit of cautious optimism, even as technical signals send mixed messages.

The VIX, often viewed as the market’s fear gauge, is sitting near 20 after briefly shooting above 28 last Friday. That suggests volatility has cooled off, though it’s still higher than usual.

On the technical side, the Nasdaq 100 has slipped out of its upward channel but is still holding above its 100-day moving average, a sign the broader uptrend might still be intact.

If support near 24,000 fails, however, there could be a steeper pullback toward 23,000. And with the VIX hovering near 20, investors are breathing a little easier, but they’re not letting their guard down just yet.

5. Asian markets surged, led by Japan’s Nikkei 225, which rose 3.37%, and Hong Kong’s Hang Seng, up 2.4%, on optimism from Japan’s coalition government deal and better-than-expected Chinese GDP growth of 4.8% year-on-year in Q3.

Indian markets showed strength, with the GIFT Nifty trading higher by 0.26%, reflecting positive investor sentiment across the region.

In Europe, markets started the week higher, shrugging off recent volatility.

The pan-European STOXX 600 index rose 0.6%, supported by a rebound in banking stocks and easing US-China trade tensions following President Trump’s comments hinting at tariff reductions.

Key sectors like banks and defense led gains, while concerns linger over credit stress in US regional banks.

The post Dow futures climb above 120 points ahead of key earnings: 5 things to know before Wall Street opens appeared first on Invezz