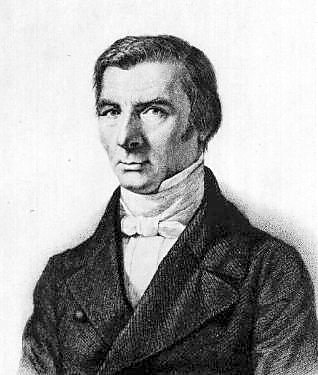

In the new Cato Institute book, Build, Baby, Build, author Bryan Caplan uses Frederich Bastiat’s economic axiom about what is seen vs. what is not seen to explain, in part, how government regulations cause housing shortages. Although Bastiat’s analysis was published in 1850, it applies today to countless instances of government intervention in the marketplace, such as housing, but also, for instance, to “forgiveness” of federal student loans and the minimum wage.

In his essay, “What Is Seen and What Is Not Seen,” Bastiat explains that in the economic sphere “a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.”

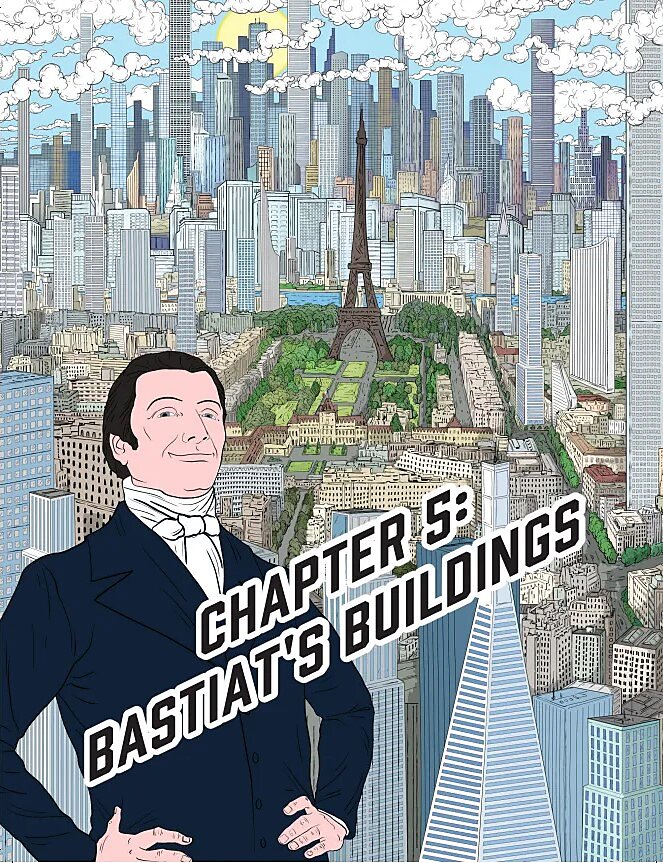

In Build, Baby, Build, a graphic novel, Caplan uses Bastiat as a character in the present day to show us “what we’re missing”—what is not seen—when it comes to housing deregulation. In one scene, Bastiat says, “Your sparkling, luxurious downtowns; this is what is seen. The cheap, abundant housing that regulation forbids; this is what is not seen.”

“Vast tracts of suburban land peppered with McMansions; this is what is seen,” says Bastiat. “The vastly larger number of homes barred by the bureaucracy; this is what is not seen.” He also looks at rent control and explains how it causes housing scarcity. Ditto for public housing: “The government’s crusade to house its people; this is what is seen. The atrocious quality of public housing; this is what is not seen.”

Towards that chapter’s end, Bastiat says, “Face it: Deregulation is by far the best remedy we have for the housing crisis.”

The overall point is to show that regulations on housing, such as rent control or zoning, produce “a series of effects,” most of which are not immediately seen (or foreseen) and are usually destructive; they inhibit investment, competition, more choices for consumers, and they reduce the supply of housing. Simply, government intervention in the housing market is a bad idea.

The same holds for student loan debt and the minimum wage. As with housing regulations, politicians and special interests don’t want to talk about what is not seen in these two cases.

For instance, the Biden administration has, so far, succeeded in “forgiving” $167 billion in federal student loan debt for 4.75 million borrowers, according to the Department of Education. This cancellation of loan debt is providing “financial breathing room and a burden lifted,” said Education Secretary Miguel Cardona. Vice President Kamala Harris said the debt relief will help borrowers to “move forward with their lives—whether they want to start a family, buy a home, or become an entrepreneur.”

Eliminating a person’s student loan debt is something that is seen—the monthly payment is reduced or ends. A financial burden is immediately lifted—“breathing room.” But this action produces a series of effects that are not immediately seen.

What is not seen is that the $167 billion is not being repaid to the government and that loss in federal revenue is transferred to the taxpayers. American workers who did not take out the loans will have to pay for those people who did.

“Make no mistake—President Biden is not ‘forgiving’ loans; he’s transferring the debt from borrowers who willingly took out student loans onto the backs of working‐class taxpayers who did not,” said the House Budget Committee in a May 2 statement.

There are other things not seen in the loan cancellation policy. With loan debt “forgiveness” always a possibility, colleges will raise their prices, students will borrow more, faith in lending will be undermined, and sensible payment options, such as income‐driven repayment plans, will be underutilized.

Like with the housing regulations, the government’s intervention—student loan “forgiveness”—creates a series of negative effects.

It’s the same story with the recent minimum wage hike in California, which rose from $16 an hour to $20 an hour for most fast‐food workers. The law went into effect on April 1 and, as many economists and libertarians warned, the cost of paying that mandated higher wage would be passed onto consumers through higher prices and through employees experiencing reduced hours, fewer benefits, and firings.

For instance, Rubio’s, a famous fish taco franchise, has closed 48 locations. Round Table Pizza and Pizza Hut announced they were laying off about 1,280 delivery drivers. This eradicates entry‐level positions that can give vital experience to young and lower‐skilled workers and provide protection against poverty. This is something that is largely not seen.

Driver Michael Ojeda, 29 years old, said, “Pizza Hut was my career for nearly a decade and with little to no notice it was taken away.” The California Business and Industrial Alliance says that about 9,500 fast‐food workers have lost their jobs because of the minimum wage hike. Many of these job losses are not seen.

As for prices, the New York Post reported, “Beverages at Starbucks stores in California were 50 cents more expensive after April 1, while Taco Bell raised menu prices by 3%.” Also, Fatburger franchises said it was planning to raise prices between 8 percent and 10 percent because of the wage increase. To the extent that poor Californians eat fast food, these higher prices reduce their standard of living. This is also not seen.

All three instances—housing regulation, loan cancellation, and minimum wage—reveal that government intervention in the economy does not produce only one effect but “a series of effects.” These unseen consequences are often disastrous and aggravate the problem they were designed to fix. Thus, we would be wise to follow Bastiat’s rule in all matters of public policy—always look for what is seen and what is not seen.